SSS Contributions Table and Payment Deadline 2020 SSS Inquiries

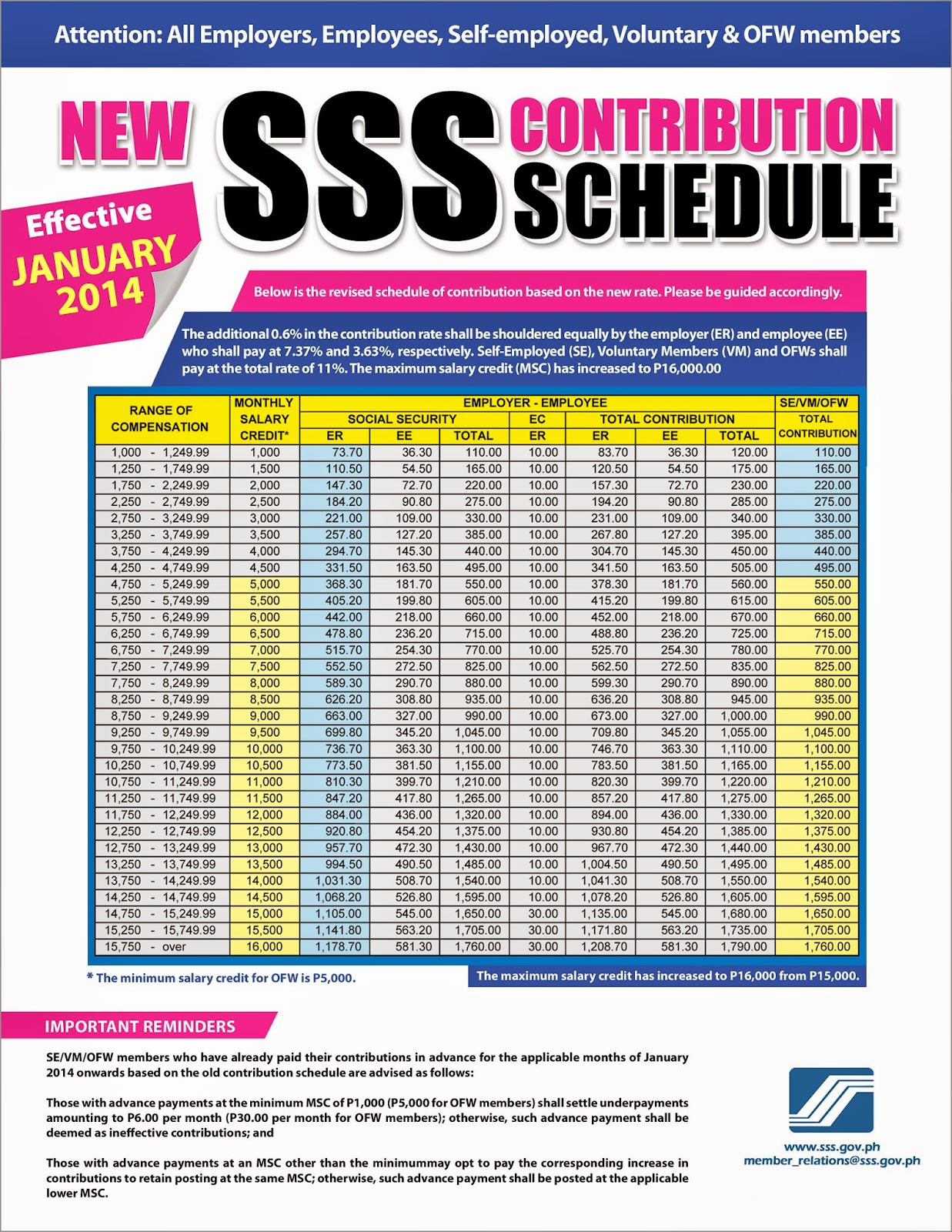

The Social Security System (SSS) is an insurance system that works alongside the government. When the Social Security Act of 2018 was established, it stated that the SSS Contribution Rate would increase by 1 percent every 2 years until 2025. With that said, here is an updated SSS Contribution Table for 2023. Social Security Act of 2018

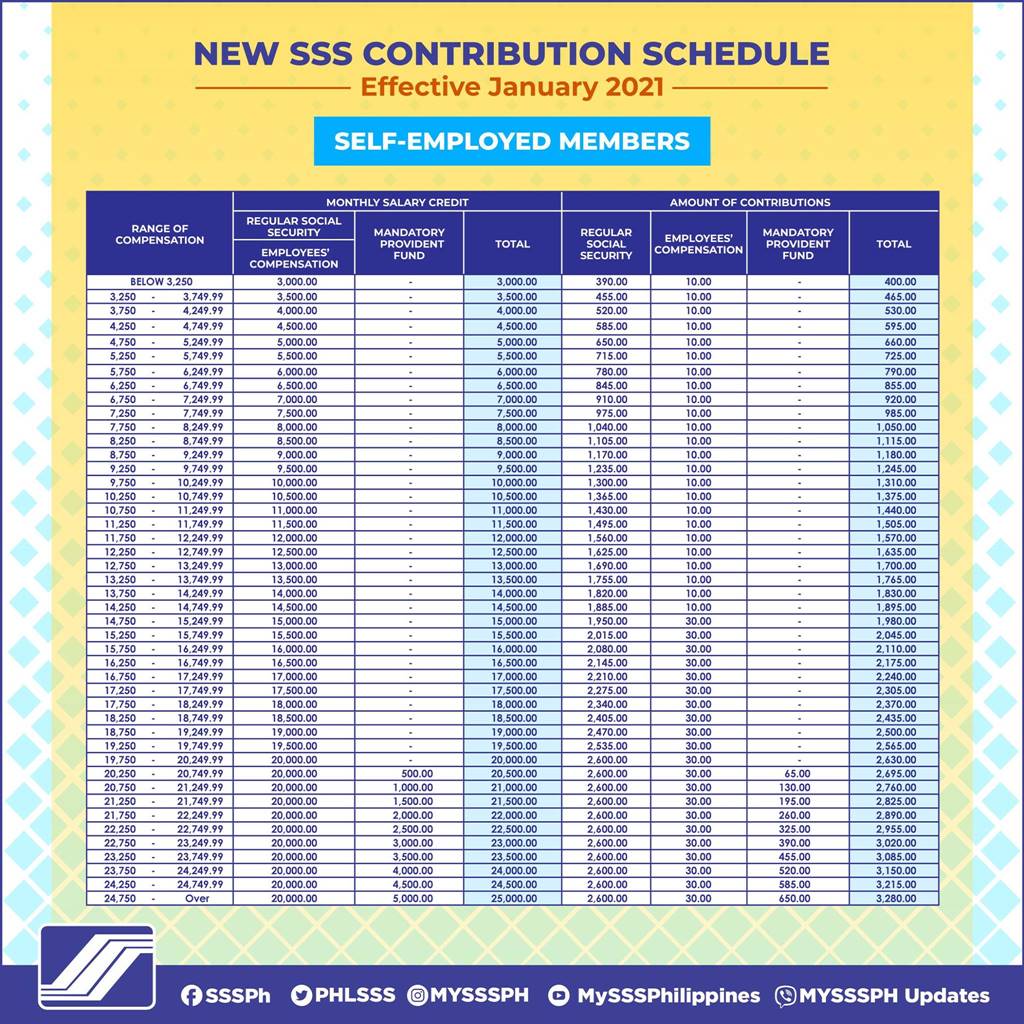

New SSS Contribution Table 2021 Sss, Table, Quick, Tables, Desk

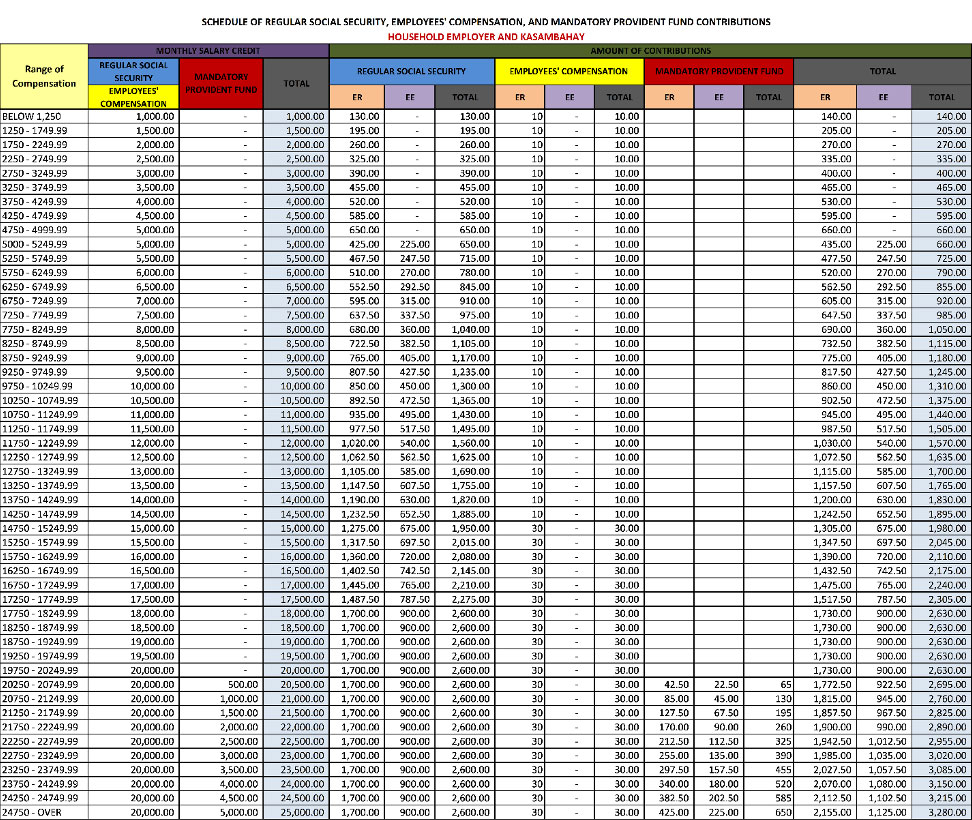

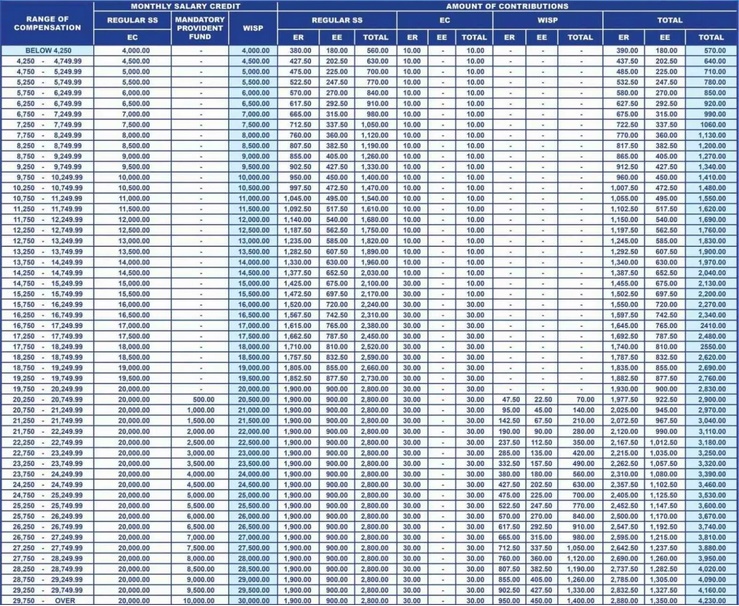

effective year 2023, the new schedule of contributions of SE member is hereby issued, and shall be effective for the applicable month of January 2023 as per Social Security Commission (SSC) Resolution No. 751-s.2022 dated 25 November 2022. The table below reflects the contributions for SS, the Employees' Compensation (EC) and the Workers

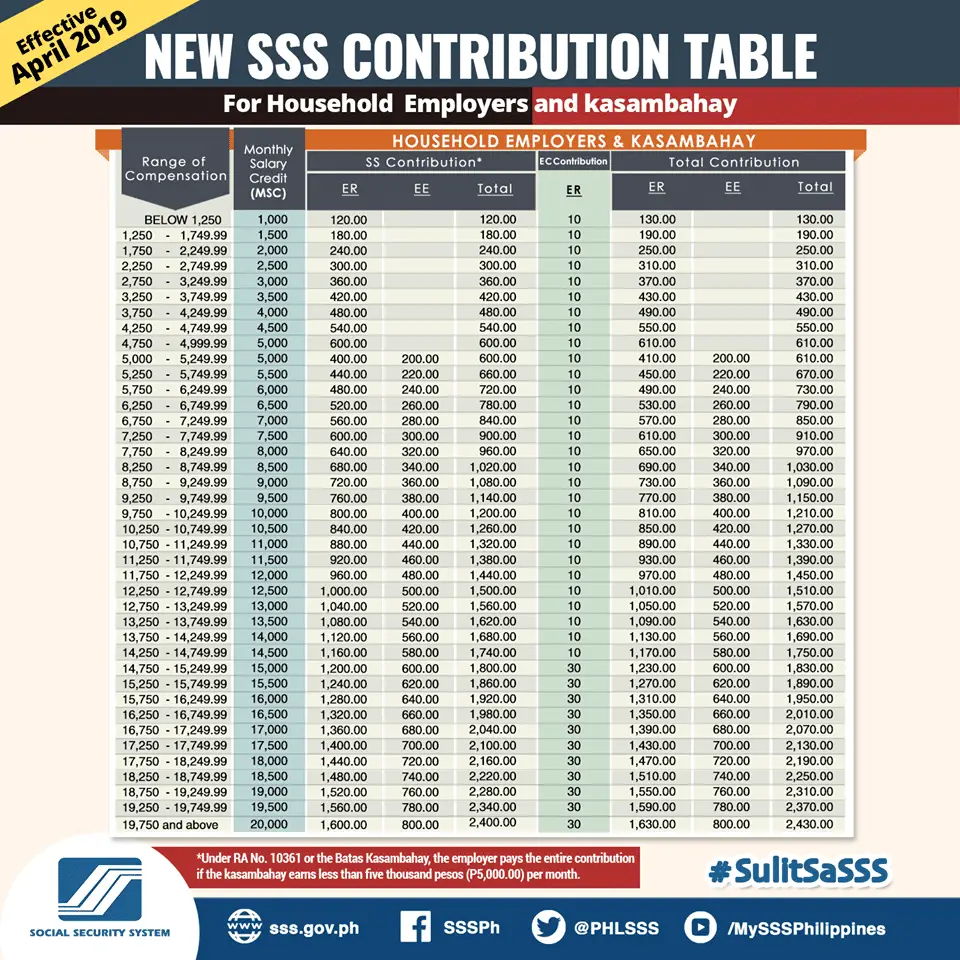

SSS Contributions Table and Payment Deadline 2020 SSS Inquiries

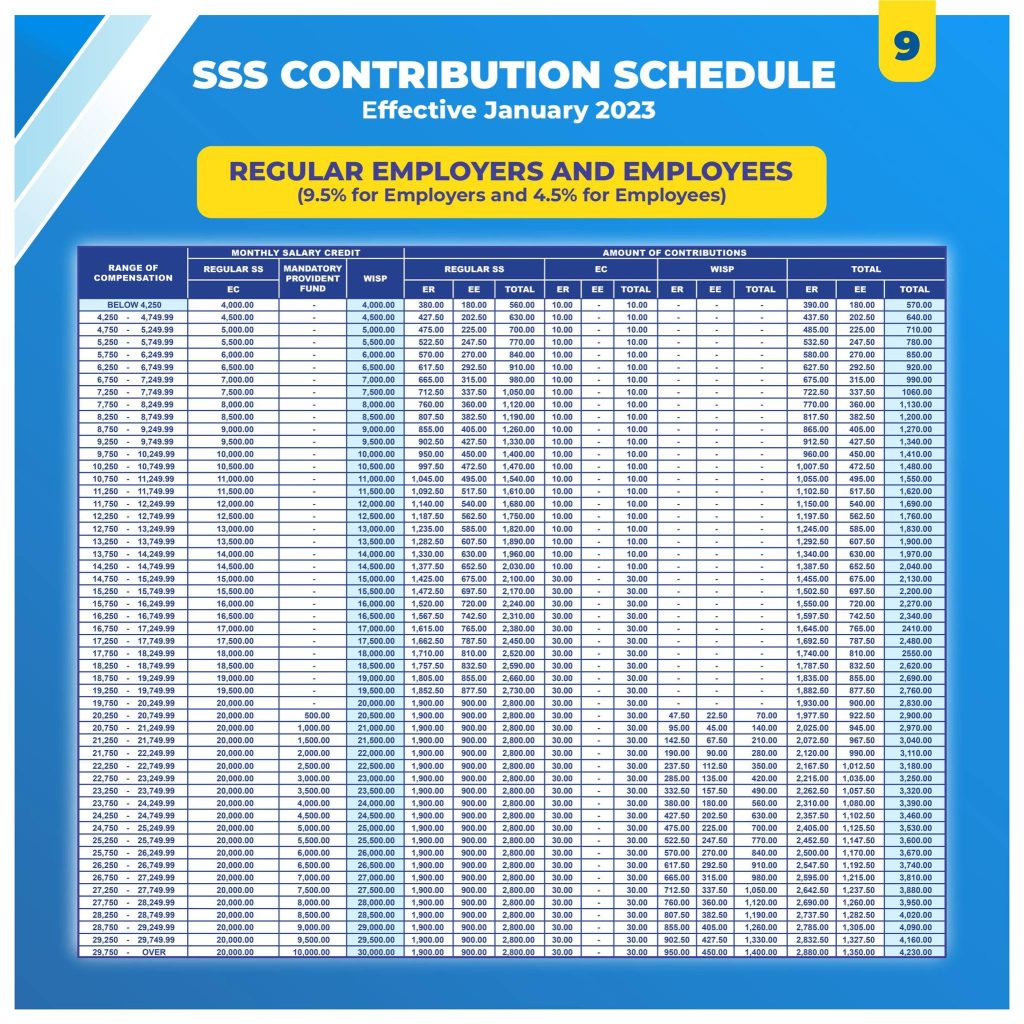

The new SSS contributions table and schedule highlight the addition of mandatory provident fund for members to implement the Workers' Investment and Savings Program ( WISP ). These are the benefits of the new 2024 rates. Employer's share becomes 9.5% while employee's shares remains the same 4.5%. Contributions starting at MSC above P20.

50 best ideas for coloring Sss Employees Compensation Computation

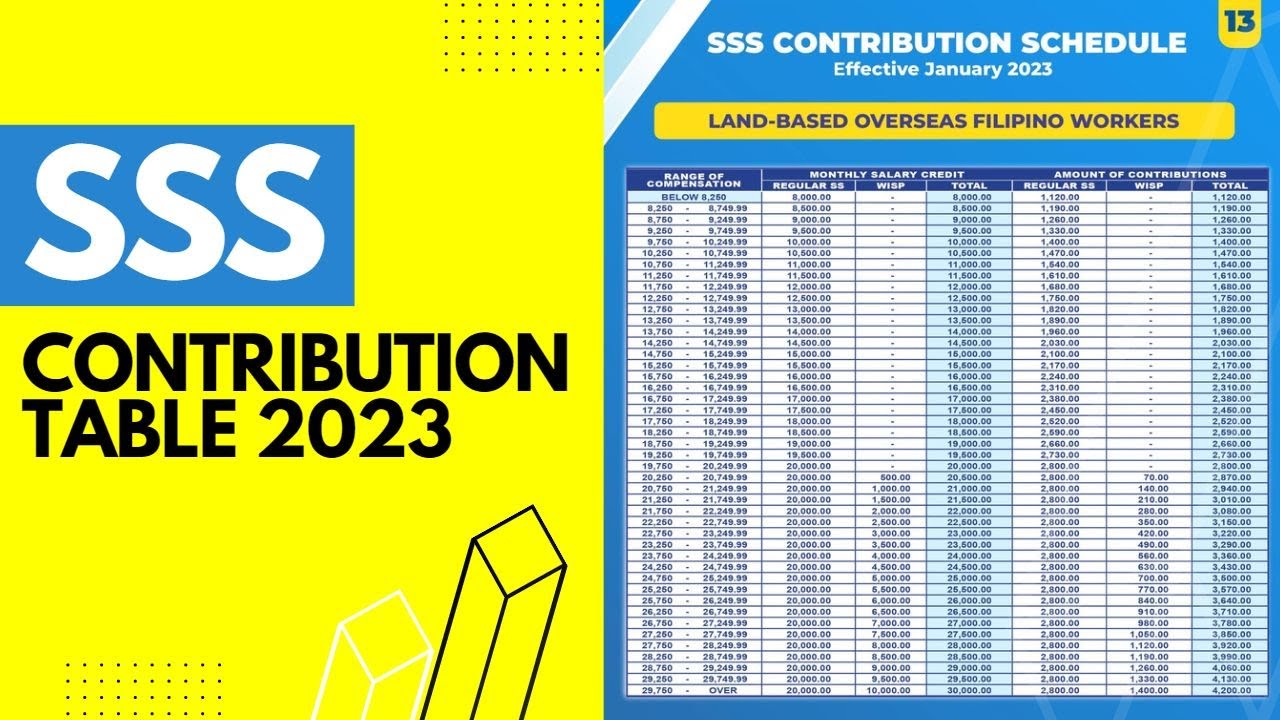

SSS Contribution Table 2023 for Voluntary and Non-Working Spouse Members. Voluntary Members (VM)Non-Working Spouses (NWS) contributing at an MSC of P20,000 and below: Additional monthly SSS contributions range from P40 to P200. For VM and NWS contributing at the maximum MSC of P30,000: The additional amount of monthly SSS contributions is P950.

New SSS Contribution Table MPCamaso & Associates

Go to the rightmost column of the Monthly Salary Credit section, then get your corresponding MSC. Compute your monthly SSS contribution using this formula: MSC x Contribution Rate = Monthly Contribution Amount. Example: Let's say your income falls between ₱19,750 to ₱20,249.99.

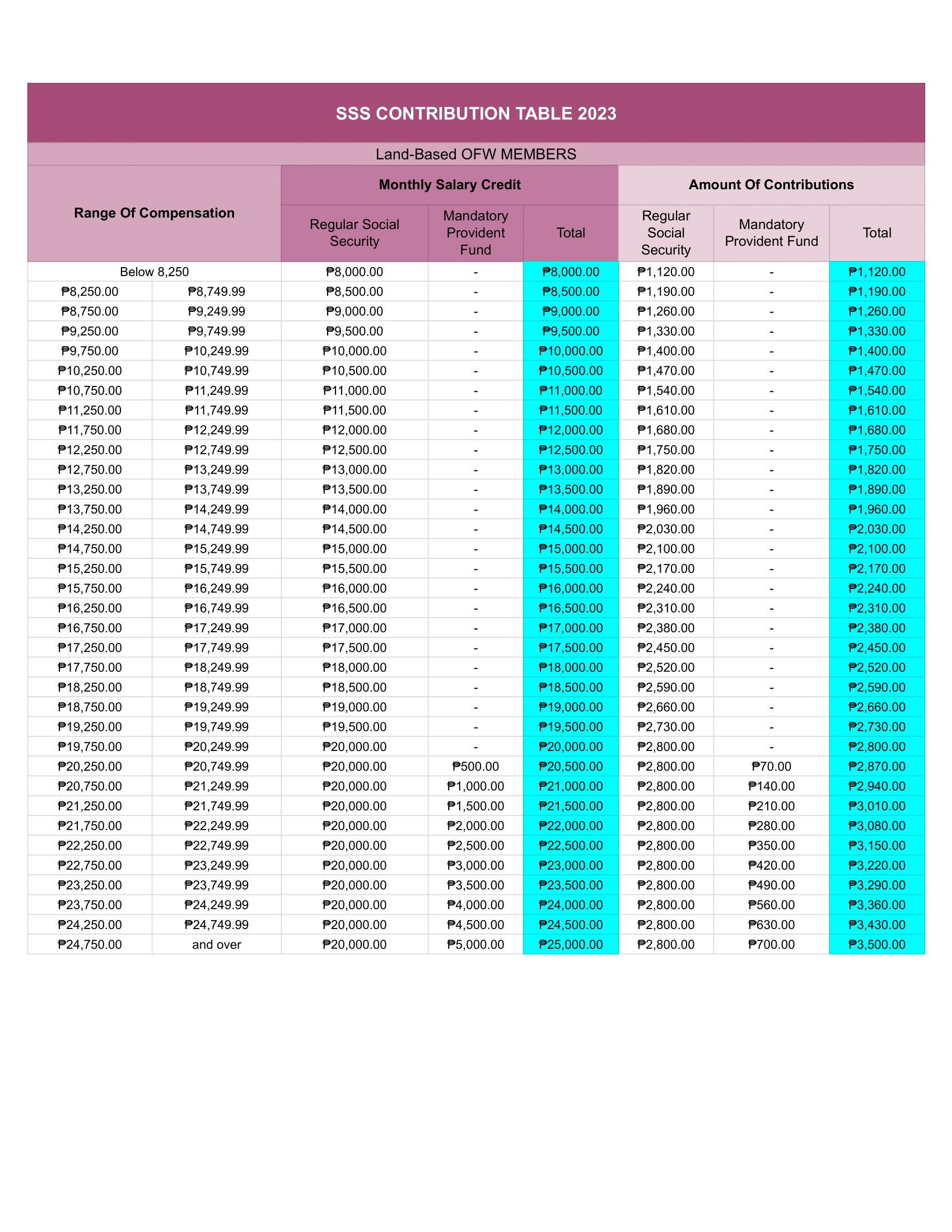

Download 2023 SSS Contribution Table and Schedule of Payments Watch online

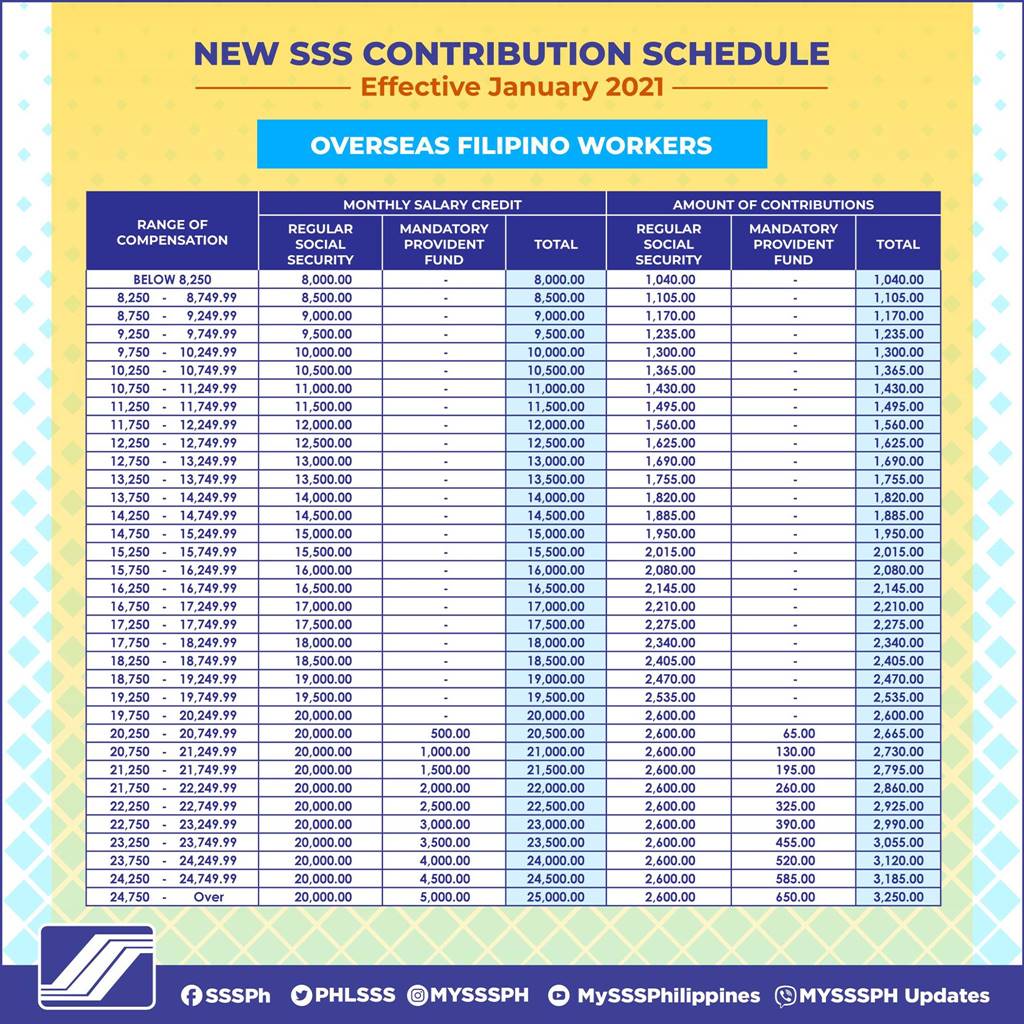

The increase in contribution for all the members including Employees, Self-Employed, Voluntary, Household workers (kasambahay), and Overseas-Filipino Workers (OFW). will be effective by January 1, 2023, with a one percent increase from the last year (13% to 14% this 2023). Under RA No, 11199, the SSS Contribution will gradually increase up to.

Monk background door sss contribution table 2018 virgin Put away

Easily calculate your monthly contributions based on your income and employment status. Our user-friendly calculator will help you determine your contribution and provide you with a breakdown of your monthly contribution based on your salary range. The SSS table is regularly updated to ensure that you have access to the most current rates.

SSS Monthly Contribution Table & Schedule of Payment 2023 The Pinoy OFW

For voluntary members, the prescribed minimum MSC is ₱4,000.00, and the corresponding employee contribution rate is 14% of the MSC, while the employer contribution rate is 8.5% of the MSC. The maximum MSC is ₱20,000.00, and the corresponding employee and employer contribution rates are ₱2,400.00 and ₱1,700.00, respectively.

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers

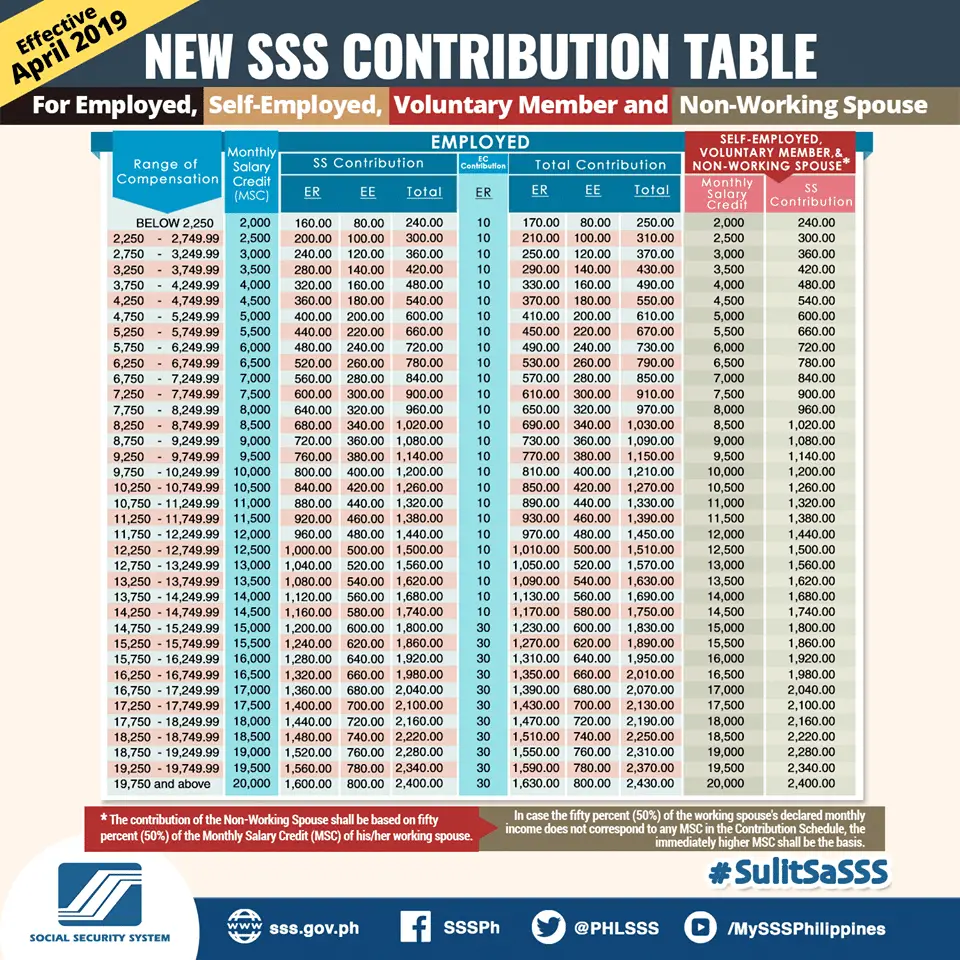

Updated. We're happy to announce that by this Friday morning (3/29), the new SSS Contribution Table is now available in Sprout Payroll. Payroll runs created for April 2019 onwards will use the new table in computing employees' SSS contributions. These new values will also be available in the SSS Contribution drop down in the Employee Profile.

How To Compute Sss Contributions In The Philippines Gambaran

Starting January 1, 2023 as per Social Security Commission (SSC) Resolution No 751-S 2022 dated November 25, 2022, the new SSS contribution rate will be 14 percent, a one percent increase from the current of 13 %. The 14 percent is composed of 9.5 % Employer Share and 4.5% Employee Share while the minimum Monthly Salary Credit (MSC) will be.

SSS New Contribution Table 2019 Effective April 2019

PP07 - Classified Medical Employees on Employer Paid Retirement (pdf) PP08K - Classified 24-Hour Shift Firefighters on Police-Fire Employee/Employer Pay Contribution Plan (pdf) PP09K - Classified 24-Hour Shift Firefighters on Police-Fire Employer Pay Contribution Plan (pdf) PP10 - Unclassified Employees on Employee/Employer Paid Retirement (pdf.

New SSS Contribution Table 2019 Effective April 2019

The 2023 SSS Contribution Table 1. Employed Members. Source: Social Security System Circular No. 2022-033. Of the 14% contribution rate, the employee pays 4.5% through monthly salary deductions, while the employer shoulders the remaining 9.5% 3.

GUIDE SSS Contribution Table 2023 WhatALife!

Here is the SSS Contribution Table 2023 for Voluntary and Non-Working Spouse Members. The SSS contribution for Voluntary and Non-Working spouse members is between 560 pesos and 4200 pesos per month. For Voluntary and Non-working spouse, based on the Social Security Act of 2018, the contribution rate is 14%.

SSS Contribution Table 2023 Here's Guide on Members Monthly

EMPLOYMENT SECURITY DIVISION State Administrative Office 500 E. Third Street Carson City, Nevada 89713 Contributions Section 1320 S. Curry Street, Carson City, Nevada

BIR Tax Information, Business Solutions and Professional System SSS

For the SSS Contribution 2023 for employed members of the social insurance institution, the employer contribution rate increases from 8.5% to 9.5%. Here are the other significant changes: the Minimum Monthly Salary Credits (MSC) is P4,000 while the Maximum MSC is P30,000. SSS members who earn below P20,000 will be facing between P40 to P200.

SSS Monthly Contribution Table & Schedule of Payment 2022 The Pinoy OFW

2023 SSS Contribution Table for Overseas Filipino Workers (OFWs) Meanwhile, below is the new SSS Contribution Table for OFW Members, indicating that the minimum monthly salary credit is PHP 8250.00. Please take note of the difference between land-based OFWs in countries that have bilateral labor agreements with the Philippines, along with sea-based OFWS, as compared to land-based OFWs in.