Paper Motor Insurance Tariff, Detariff and Beyond... (India)

General Regulation ('GR')-36 of India Motor Tariff('IMT'), 2002 mandates General Insurance Companies carrying on motor insurance business to provide Compulsory Personal Accident (CPA) Cover for Owner-Driver under both Liability Only and Package policies.

Indian Motor Tariff Vehicle Insurance Insurance

tariff advisory committee 1-1-01 2 the tariff advisory committee (hereinafter called the committee) has laid down rules, regulations, rates, advantages, terms and conditions, as contained herein, for transaction of contractor's all risks insurance business in india in accordance with the provisions

[MINDMAP] The challenge of skilling India INSIGHTSIAS

The Indian Motor Tariff 2002 (often abbreviated to "Motor Tariff") has been the defining regulatory framework governing motor insurance policies in India. Within this document, Clause 7 of Section 2 specifically addresses the situation involving a private car owned by an employer and used for transporting employees.

Why Is Indian Less Concerned About E.U. Tariffs Than Harley?

CPA was introduced in 2002 after the revision of motor tariffs. The motor tariff is mandatory if it is registered under the name of an individual. CPA tariff is included under the third-party premium component. The maximum compensation with the default CPA for vehicle owners was Rs. 1 lakh.

Red Indian Motor Oil SSP, Canada 12x29 at Chicago 2018 as Z219 Mecum

For the transaction of motor business in India in accordance with the provisions of part II-b of the insurance act 1938, the tariff advisory committee have . insures may restrict the cover under the standard B policy form without reduction in premium or they may increase the premium for the same or restricted cover without obtaining the permission of the miscellaneous sub-committee of the.

IRDA Motor Tariff 2023 2024 EduVark

ORIENTAL INSURANCE COMPANY LIMITED (ALL INDIA MOTOR TARIFF Revised as on 01.06.2022 ) TWO WHEELER ZONE ZONE A ZONE B Age of Up to 151 to Above Up to 151 to Above Vehicle 150cc 350cc 350cc 150cc 350cc 350cc

Pin on Growing Wealth

An analysis of the above facts shows that the relevant provisions, (General Regulation 8 of All India Motor Tariff, 2002) and those of relevant guidelines indicated under charge no.2 above, have been violated to the extent of having been non-transparent regarding deductions made from the claims. The Insurer has maintained that the claimants.

IRDA Motor Tariff 2023 2024 EduVark

Description for CBICWEBSITE. Calling for option for posting on promotion to the grade of Joint Commissioner vide Office Order No. 220/2023 dated 21.12.2023 Final zone allocation of Candidates selected through SSC CGLE 2023 -reg. Annexure-I Annexure-II Annexure-III Annexure-IV Annexure-V International Customs Day (ICD) Celebration 2024: Seekingnominations for award of WCO Certificate of Merit.

Motor Tariff PDF

Introduction. Motor insurance business in India is regulated under the India Motor Tariff 2002 (IMT) issued by the erstwhile Tariff Advisory Committee in 2009.While pricing of the Own Damage segment was de-tariffed in 2007, the basic product structure, including the policy wordings and other standard forms, continues to be governed by the General Regulations (GRs) and various other provisions.

A Mental MindMap of Assembly 4.0 Aspects Download Scientific Diagram

erstwhile Indian Motor Tariff (IMT) has been proposed for those private cars identified as Vintage Cars by the Vintage and Classic Car Club of India. A discount of 15% is proposed for Electric Private Cars, Electric Two Wheelers, Electric Goods carrying Commercial Vehicles and Electric Passenger carrying.

Motor Vehicles (Third Party Insurance Base Premium and Liability) Rules

IMT, short for "Indian Motor Tariff," is a set of guidelines and provisions established by the Insurance Regulatory and Development Authority of India (IRDAI) for motor insurance in India. IMT 29, in particular, plays a crucial role in protecting policyholders against unforeseen events and financial losses.

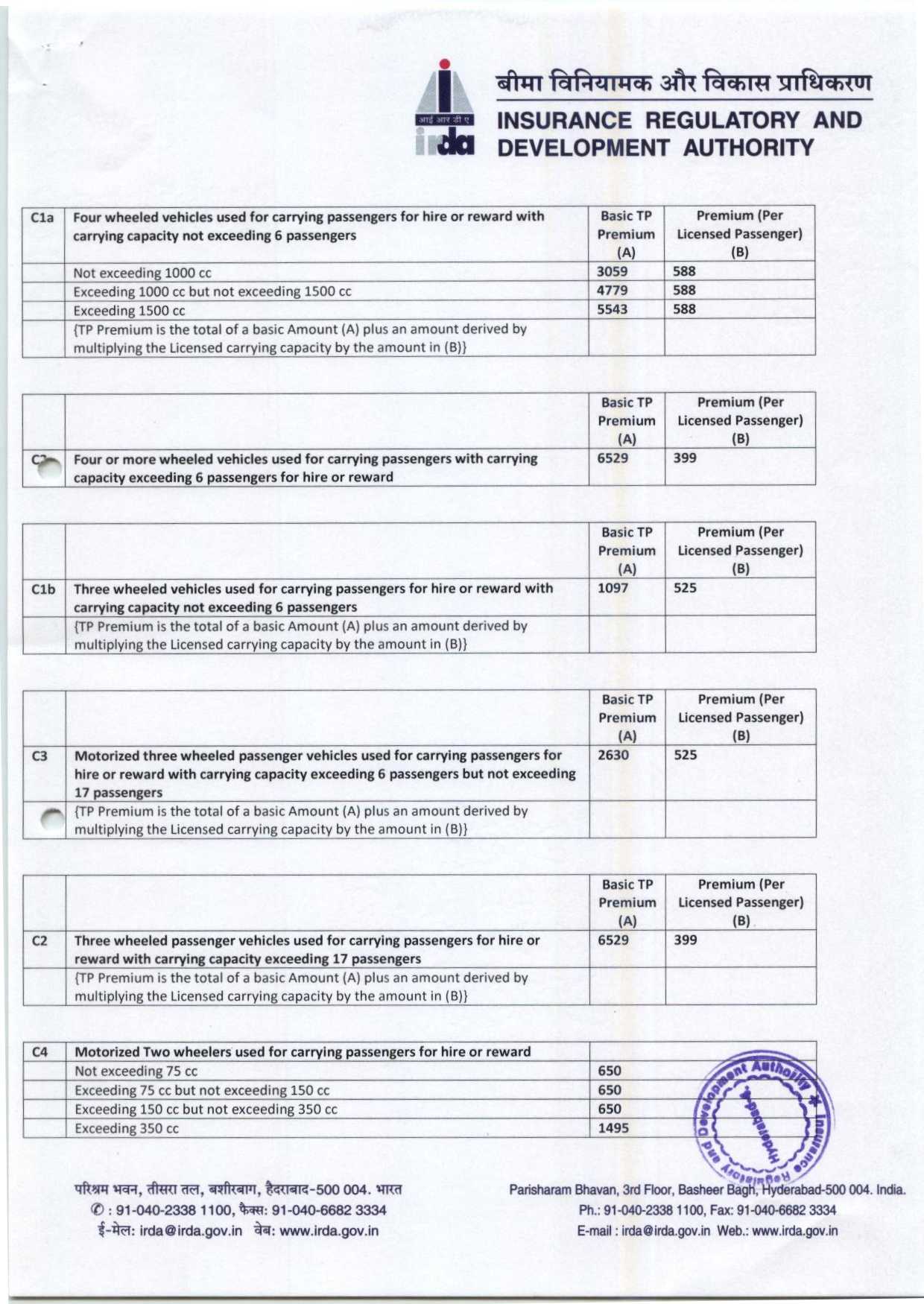

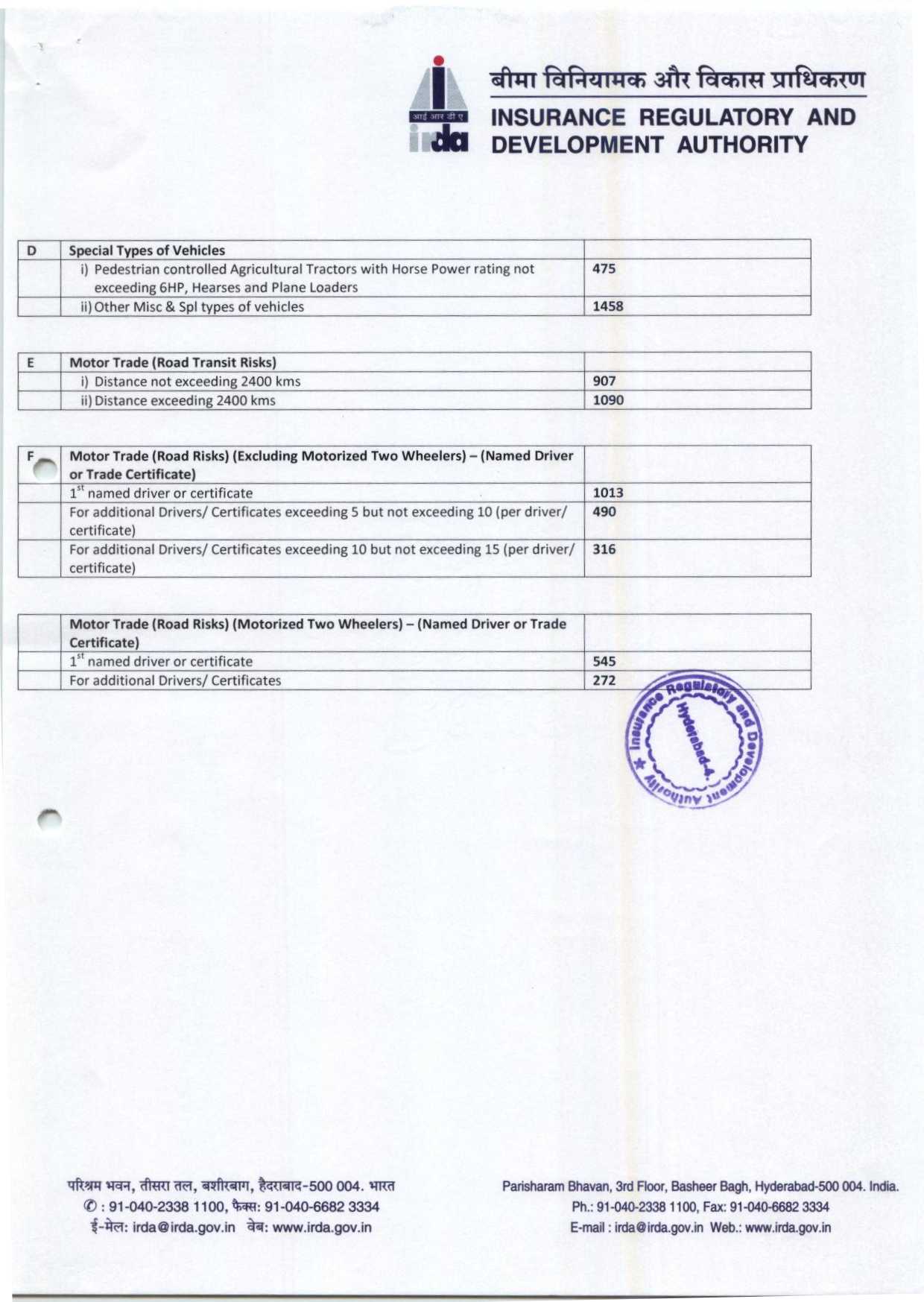

New Motor Tariff Revised t.p 2012 Insurance Vehicles

The IRDAI has reiterated that in the event that a motor vehicle is sold or transferred, the guidance provided under General Regulation 17 of the India Motor Tariff (ie, transfers) will apply.

Download India Motor Tariff 2002 file in doc format

india motor tariff india motor tariff the tariff advisory committee (hereinafter called tac) have laid down rules, regulations, rates, advantages, terms and conditions as contained herein, for transaction of motor insurance in india in accordance with the provisions of part ii b of the insurance act, 1938.

IRDA Motor Tariff 2023 2024 EduVark

INDIAN MOTOR TARIFF Budget 2024: Will interim budget roll out the red carpet for Tesla? Union Budget: India is positioning itself to welcome Tesla, buoyed by efforts to ease import duties and facilitate the electric vehicle (EV) giant's potential investments.

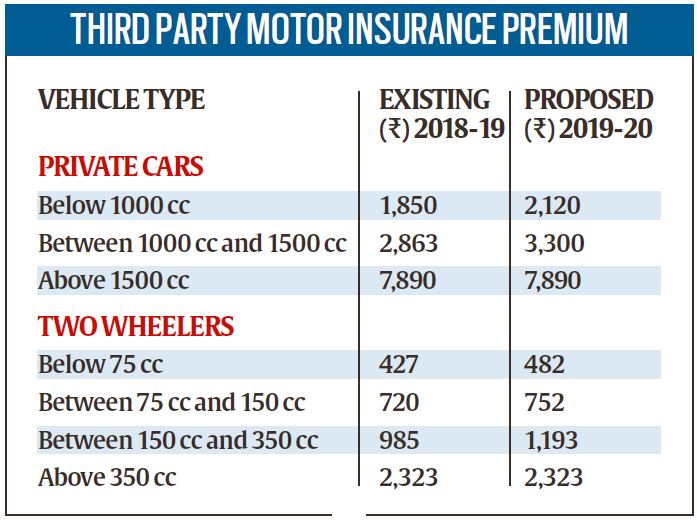

IRDAI proposes 15 hike in thirdparty premium on small and medium

An IDV (Insured Declared Value) in car insurance is nothing complicated but, refers to the market value of your car. In other words, it is the amount your car could receive in today's market. This IDV in car insurance helps your insurer, a.k.a us determine your claim amounts correctly during claim payments.

Red Indian Motor Oil SSP, Canada 12x29 at Chicago 2018 as Z219 Mecum

The goods cost $28,000. To find out how much you'll need to pay, you'll need to check the commodity code for umbrellas, and apply the import duty rate for that code — 6.5%. Tax will be due on the cost of the goods without shipping, which in this case is $28,000. 6.5% of $28,000 is $1,820. So for the good and customs duty, you'll pay $29,820.